Executive Sommary

As in all Europe the Italian airline sector is passing through changes. After the affection of the terrorist’s acts, the increasing operation the low-cost airlines are altering the habits of the passengers providing a possible structural change. While they offer the consumers the opportunity to travel more they are answering with increasing preference and spends on air travel.

The US$ 7,7 billion market has seen its main airline company decreased its market share from 61% to 46% in four years whereas the low cost companies have improved their position and multiplied themselves. In fact new destinations, passengers and spends are shocking the competition in making the companies review their patterns.

However the configuration of the market and the consumers’ preferences are influenced by some crucial facts that are still decided. These facts will determinate the competition and are linked principally to costs and safety. On one hand the companies need to be profitable and able to compete by leading with factors such as the increase in petrol prices and success of their business model while on the other hand the safety, the investments in tourism and the mobility of the people will delineate the growth of the sector and the its destinations.

As regards this uncertain and open competition, the forecast of the aviation sector scenarios is truly important to succeed. For this purpose, the Italian airline market and its crucial factors have been analysed and the Cross Impact Analysis methodology was used to valuate potential scenarios and quantify the forecasts. Then a most probable scenario between a positive, a neutral and a negative was calculated and analysed.

The positive scenario predicted a ‘boom’ at the aviation market pushed by the necessity of mobility, tourism and new products and services. However, the negative scenario was concerned about economic and safety destabilisation coming from accidents resulting in a progressive decrease of expenses, both with low probabilities.

Nevertheless the most probable scenario is the neutral risk one with a low decrease of the growth rates and profits. It would succeed by the reduction of consumer’s disposable incomes and raise the companies costs to margin pressures and sector establishment.

An introduction to the Italian airline industry

In Italy, the airline industry is quite predominant amongst the means of transportation; indeed, the sector represents the largest turnover in the travel industry.

We will briefly introduce the market share of the airline industry on the Italian market, the different low cost competitors, the different classes on board, the current trends as regards the flights, and theh big airline companies such as Alitalia. We will conclude with the future trends that may arise in the sector.

Recently, the no-frill operators have had a considerable impact on the airline industry as they attract many Italian travellers looking for cheap flights. Furthermore, as the Italian have become eager clients to this kind of operators, it has had an impact on their lifestyle and habits; indeed, now they can travel more and go further away than they used to. However, this result had a strong negative effect on the other means of transport especially the railway and ferry sectors: now that Italians can fly over the country for lower prices, they are no longer using the rail and ferry transports so much. Indeed, the national rail transportation company TreniItalia, highly suffered from the success of the no-frill operators. According to the table below, we can see that the airline industry has seen its sales boosting from 1999 to 2004.

Table 1. Transportation Sales in the Italian airline industry:

Value 1999-2004

|

1999 |

2000 |

2001 |

2002 |

2003 |

2004 |

| Air (Euro Million) |

5,752.7 |

6,559.8 |

6,997.2 |

7,131.4 |

7,349.5 |

7,683.6 |

Source: ENAC (Ente Nazionale per l’Aviazone Civile), Confturismo, TCI, Euromonitor

According to the table below, the airline sector represents the biggest transportation sector in Italy from 1999 to 2004;

Table 2. Transportation Sales by Sector: % Value Breakdown 1999-2004

% value

|

1999 |

2000 |

2001 |

2002 |

2003 |

2004 |

| Air |

62.8 |

65.0 |

64.8 |

64.9 |

65.2 |

66.1 |

| Bus/coach |

6.0 |

5.7 |

6.0 |

6.1 |

6.3 |

6.3 |

| Chauffeur-driven car |

1.0 |

0.8 |

0.8 |

0.8 |

0.8 |

0.8 |

| Cruise |

3.1 |

3.1 |

3.1 |

3.2 |

3.3 |

3.1 |

| Ferry |

7.0 |

6.7 |

6.5 |

6.4 |

6.3 |

5.9 |

| Rail |

20.1 |

18.7 |

18.9 |

18.6 |

18.2 |

17.8 |

| Transport by sector |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

Source: ENAC (Ente Nazionale per l’Aviazone Civile), Confturismo, TCI, Euromonitor

Even though the airline industry is still the most profitable transportation sector, people are less eager to travel since the 11th September attacks and the war in Iraq. However, the airline companies’ internet sites which allow online bookings for flights attract more consumers, hence compensate for those negative trends.

As regards the different types of consumers, the majority is represented by ordinary people travelling for leisure; those register to the economic class which represented the broad majority of airline volume sales in 2004. The other type of customers is characterized by the business people travelling for their work. These will register to the business class which offers special services and dedicated treatment on board. The low-cost operators don’t usually offer business classes; however, some operators are starting to invest in that segment like CorpFlex or Volare Web.

The big majority of the flights are short-haul; indeed, in 2004, the short-haul flights represented a 96% share of all volume. Long-haul fights were badly affected by the September 11 attacks. However, the profit gained by the short-haul flights compensated for the loss that touched the long-haul flights.

As we’ve seen before the no-frill airline companies are very lucrative and the cause of this is mainly due to their high presence on the internet. Ryanair, Easyjet and Volare Web are the most famous ones, especially Ryanair which generated a profit of more than € 230 million in 2004, most of which (about 95%) was represented by on-line purchases. The company offers many flights from Milan and Rome to European cities such as Paris, London and Dublin.

The Italian low-cost company, Volare Web, is the first Italian airline company which has imitated the Irish company in selling cheap flights. The most important Italian company remains Alitalia which acquired a few small airline companies such as Gandalf airline in 2004, has seen its sales significantly drop in 2004: indeed, the company registered a 13% decrease in its revenues. This was due to the uncompetitive structure of the company and the great difficulties involved in trying to reduce the size of its labour force because of the strong opposition of the main unions. Volare Group is now the second largest company in terms of turnover on the Italian market.

Tabel 3. Airline Companies by Market Share 2001-2004

% retail value rsp

|

2001 |

2002 |

2003 |

2004 |

| Alitalia SpA |

61.0 |

58.0 |

52.0 |

46.0 |

| Volare Airlines |

7.7 |

7.8 |

8.2 |

8.7 |

| AirOne SpA |

3.9 |

5.2 |

5.4 |

5.4 |

| Meridiana SpA |

4.0 |

4.8 |

5.3 |

5.4 |

| Deutsche Lufthansa AG |

4.4 |

4.2 |

4.1 |

4.1 |

| Ryanair Holdings Plc |

2.0 |

2.4 |

2.9 |

3.1 |

| British Airways Plc |

3.0 |

2.8 |

3.0 |

2.9 |

| Air France Group SA |

3.2 |

3.1 |

2.9 |

2.8 |

| IBERIA |

2.3 |

2.1 |

1.9 |

1.8 |

| Others |

8.5 |

9.7 |

14.2 |

19.8 |

| Total |

100.0 |

100.0 |

100.0 |

100.0 |

Source: Company profiles, trade press, ENAC, Euromonitor

As regards the market share, as it is seen above in the table, it is dominated by the local airline companies: Alitalia held 46% of the market in 2004, having lost 15% of its market share from 2001 to 2004. This decrease benefited to the other local companies such as Volare, Meridiana and Air One. Volare AirLines and AirEurope form Volare Group, which was the number two player with a turnover of EUR600 million in 2004 and overtook Meridiana, which had been the second-placed company until 2000. Following the worrying financial troubles of Volare Group in the end of 2004, Meridiana has expressed strong interest in acquiring the domestic activities of the group. An operation that could give rise to a solid local competitor for Alitalia.

As regards the forecasts for the Italian airline industry, it will be strongly related to Alitalia’s financial health. Indeed, the company still needs to increase its market share and attract more customers in order to compete efficiently with other bog companies local or international.

The industry will however continue to benefit from the success of the low cost airlines which are becoming more and more predominant and lucrative. Thus we can say that Alitalia will have to either reposition on the market (lower its short-haul flights’ prices) or find some kind of partnership with the low-cost operators which otherwise may highly take over its customers travelling in the country and even abroad.

***

Methodology of our Scenario Planning research

During the scenario planning process due to the complexity of aviation industry we decided to apply following framework:

1. Analysis of the business environment and impact of economic development

2. Definition of potential scenarios

3. Evaluation of their probability

4. Quantitative forecasting.

a. Relations of economic indicators and spending on air travel in Italy

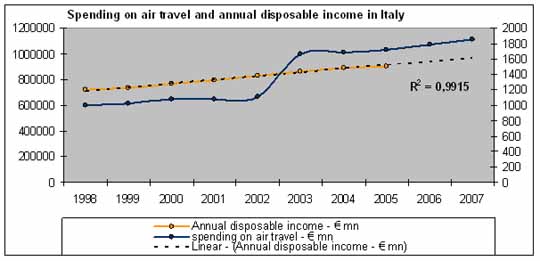

The correlation of disposable income and spending on air travel is strong therefore forecasts concerning economic development can be applied to estimate the change of market value. As it can be seen on the following graph curves are almost parallel..

Graph 1.

The increase of spending in 2003 is the result of an introduction of the first low-cost airline – Volare Web – on Italian market. It’s crucial to notice that after the surge caused by this event the growth rate became again corresponding to the growth rate of a disposable income.

However, taking under consideration annual percentage of disposable income spent on air travel it appears that the ratio value is starting to slightly decrease. Again, continuation of a trend present until 2002 is noticeable. The reason is increasing level of satisfaction and fulfilling of clients expectations.

Taking under consideration mentioned discoveries we can apply the economic trends and forecasts during the scenario planning process.

b. Probability evaluation

In order to evaluate the probability of crafted scenarios we used a simplified version of Cross Impact Analysis. First step was a definition of a set of the most crucial factor influencing each scenario. Afterwards the probabilities of associated factors were calculated.

Selected main factors:

Optimistic scenario: Dynamic economic development and internationalization.

Neutral scenario: Stable but slow economic development combined with increasing mobility.

Pessimistic scenario: Terrorism and/or air plane accident in low-cost sector.

Following chart represents aggregated probabilities with a calculated likelihood of occurrence for each scenario.

Table 4.

| Factor |

Probability |

Positive |

Neutral |

Pessimistic |

| Black list of unsafe airlines |

30,00% |

0 |

0 |

1 |

| Decrease of prices |

80,00% |

1 |

0 |

0 |

| Economic crisis or recession |

20,00% |

0 |

0 |

1 |

| Ethnic problems |

20,00% |

0 |

0 |

1 |

| Failure of the business model |

30,00% |

0 |

0 |

1 |

| Huge rise of petrol prices |

30,00% |

0 |

0 |

1 |

| Massive increase in tourism investment |

66,00% |

1 |

0 |

0 |

| Increasing mobility of population - younger generations are much more mobile than older people |

95,00% |

1 |

1 |

1 |

| Increasing prices of petrol which makes the flight prices go up slightly |

70,00% |

0 |

1 |

0 |

| Introduction of more internal connections or even transatlantic ones |

66,00% |

1 |

1 |

0 |

| Introduction of new competition - new cheaper business models |

40,00% |

1 |

1 |

0 |

| Low-cost carrier accident or crash |

1,00% |

0 |

0 |

1 |

| New popular destinations : Middle East, Africa, Eastern Europe |

50,00% |

1 |

1 |

0 |

| Noticeable growth of GDP |

10,00% |

1 |

1 |

0 |

| Search for cheaper holidays, lower air fares |

80,00% |

1 |

1 |

1 |

| Stable but slow growth of GDP |

60,00% |

0 |

1 |

0 |

| Stable growth due to popularization |

60,00% |

1 |

1 |

0 |

| Terrorism |

20,00% |

0 |

0 |

1 |

| Scenario probability |

0,3178% |

2,5281% |

0,0002% |

Our calculations assume that all factors have to take place and take under consideration the probability of happening of the main factor. Using not aggregated approach would increase the calculation results. On the other hand, estimation of likelihood of extreme situations presents a wider picture of the future. Combining the outcome of quantitative estimation with market trends and related forecasts we decided that the most probable situation is a neutral one.

c. Forecasting

Air travel sector is a developed market actually facing low-end disruption from the low-cost companies. The need to travel by air is indubitable and increasing. Taking under consideration this trend we decided to apply the trend impact analysis framework using previously defined events.

d. An explanatory analysis of three potential scenarios: positive, neutral and negative

| Positive scenario : increase of mobility and destinations |

- Increase of mobility

- Introduction of more internal connections or even transatlantic ones

- Decrease of prices

- New popular destinations : Middle East, Africa, Eastern Europe

- Increase in tourism investment

- Introduction of new competition - new cheaper business models

- Noticeable growth of GDP

In an optimistic scenario, we would like to believe that Italians will become more mobile in their travel patterns, and that airlines will continue to increase the number of destinations to which they fly to.

Italians are finding that traditional tourism destinations have become overly developed and crowded, and are now searching for new destinations that have the potential to offer quiet beaches and historic or cultural attractions, preferably at a low cost. As a result, new tourism markets are continuously emerging, and Italians are discovering new areas that are relatively close to Italy.

Middle Eastern destinations are becoming more and more trendy, as well as Eastern European countries. As a consequence, airlines are increasing seeking to schedule regular flights to these new tourist hubs, to reply to demand for travels to these new destinations.

In 2004, Qatar announced its plans to spend over US$15 billion on tourism development, including a new US$5 billion international airport for Doha, eight new luxury hotels and two beach resorts. Qatar predicts tourism numbers to more than double over the coming six years, from around 400,000 tourists in 2004 to more than one million by 2010.

Dubai is also investing greatly in tourism. There are already 272 hotels, which will be completed by a further 120 over the next 15 years. ‘The World’,a group of 200 artificial islands off the coast designed to look like a map of the world, is to be finished by 2008. Jordan expects to invest US$150 million in tourism facilities in the coming years, with a focal point on developing regional and eco-tourism. Yemen is also planning to open its first tourist office in Europe to increase awareness of the country, which has a 2,500km of coasts.

Other areas of Africa and the Middle East that are expected to grow strongly include Egypt and Morocco, which are both ploughing significant sums into resort development, as well as newly emerging African destinations such as Cape Verde. In the longer term, countries that are currently politically unstable but which offer tremendous opportunities for tourism in the future include Iran, Iraq and Libya.

The Eastern European tourism is counting on the Balkan states of Serbia & Montenegro, Croatia and Slovenia to promote new cheaper holiday destinations. These countries offer relatively cheap holidays, attractive scenery, beaches and spa facilities, and are profiting from increased flight plans by European low-cost airlines.

This is an extremely positive, optimistic and beneficial scenario to which the airline industry in Italy is already well prepared to, and exploiting the potential. Scenarios like these are beneficial as they help to reboost the economy and contribute to healthy competition in the industry.

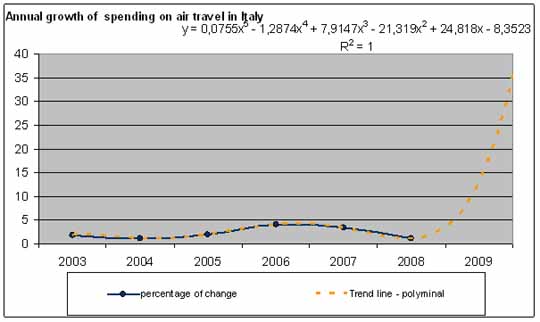

Graph 2.

As it was previously stated we expect a boom in the industry. After the period of stable growth of spending the amount of purchases is going to significantly increase. Introduction of new services, destinations and business models combined with prices decrease would attract even more passengers. The internationalization and mobility make the air travel a popular way of transportation.

| Neutral scenario : the amount people spend on air travel goes down |

- Decrease of spending per capita on air travel

- Search for cheaper holidays, lower air fares

- Increasing prices of petrol which makes the flight prices go up slightly

- Increasing competition leading to introduction of new destinations

- Increasing mobility of population - younger generations are much more mobile than older people

- Stable growth due to popularization

- Stable but slow growth of GDP

In this scenario, we accept that airline customers are spending less on airline travel. This is in the first case to the detriment of other transportation means, and in the second case on cheaper air fares. However, this scenario is problematic for the industry as it accompagnied by the airline’s need to increase prices.

In the first case, Pricing has been one of most controversial issues for the tourism industry between 2003 and 2004. The widespread growth in prices that followed the introduction of the euro and the discrepancies between inflation rate official data and the perceived/real inflation created a general negative background, in particular for domestic tourism. The petrol price has risen significantly since August 2004, which has impacted the budget Italian households devote to travelling, and the amount they can place in air travel.

In the second case, Italians have been seeking cheaper holidays, lower air fares and cheaper European destinations rather than long-haul foreign and exotic destinations, meaning the number of expensive flights booked is decreasing. Italians are also more aware of transparent prices, which are becoming a major attribute in the travel industry in the future. Undeniably, whereas travel and tourism businesses segmented consumers according to needs, or business and leisure, and maintained large differentials in pricing, with the development of the Internet, consumers and business travellers find it easier to search for fares and rates, and it has become standard behaviour to compare, and to select the service and price that suits them best.

However, as airlines are needing to increase their prices or attempt to cut cost, it is having an impact on the industry. One of the major challenges facing the tourism industry are the increase in costs, leading to margin pressure. This follows a period of intense competition and low prices, as companies encouraged people to travel in the aftermath of the various calamities that have hit the industry in recent years. Competition from low-cost airlines forced major carriers to lower prices, at a time when fuel costs were rising. This will necessitate cost cutting in the future.

However, we can consider this scenario as being only a neutral/average risk scenario. Although there is an impact on the industry, it will be relatively slow and the airlines will have the time to become more reactive and more aware of the competitive pricing environment.

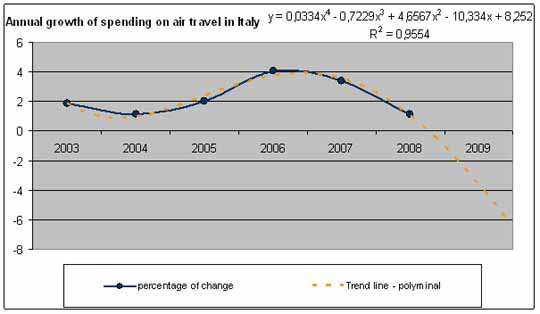

Graph 3.

The increase of spending is still noticeable however the growth rate slows down potentially leading to slight lowering of sales in next decreasing business cycle. Decline is noticeable however it doesn’t affect much the market since people still prefer to use air transport for a long distance travel.

| Negative scenario : European low cost carrier accident |

- Low-cost carrier Accident or crash

- Huge investments of low-costs carriers not paying off

- Black list of unsafe airlines

- Huge rise of petrol prices

- Failure of the business model

- Economic crisis or recession

- Ethnic problems

- Economic slow down and recession

- Terrorism

This scenario is the scenario that has been haunting every low-cost carrier, as the industry would almost certainly die, or be painfully affected, if a accident or crash would occur.

Whilst the advent of an accident is controllable with thorough safety, technical and security checks, no airline is safe from an accident. In addition, an accident occurring in one airline would impact all other low-cost carriers, depending on how serious the accident (considering factors like technical issues, casualties, media coverage, accident location)

The low cost carriers are planning to develop even further and become even greater market players. Indeed, the booming development of low-costs airlines is followed by some bankruptcies, mergers and new budget airlines entering the market.

Major airlines are also starting to adopt a low-cost model, and United Airlines, Aer Lingus and Delta Air Lines already starting on this path.

In Europe, the largest low-cost airlines, such as Ryanair and EasyJet, have projected to expand even further. In early 2005, Ryanair declared that it had ordered 70 Boeing 737s and had taken an option on a further 70. The aircraft should be useable between 2008 and 2012, and are in addition to 100 new 737s will be brought by the end of 2005. Ryanair forecasts to see passenger numbers more than double from the 34 million anticipated in 2005-2006 to over 70 million once all the new air planes have been finalised, making it the largest airline in Europe by 2011-2012.

However, an accident would seriously hinder these ambitious plans. Even if all the other players would launch a very high scale campaign to claim their security, revealing their budget on safety matters and maintenance, consumers would be generally more wary and place a higher value to their safety whilst flying. In addition, major airlines would use these incidents to claim their superiority and justify their higher prices.

In addition, every government is now publishing black lists of unsafe airlines, and if a European low-cost carrier found its way on one of these lists, it would have major repercussions and institute formal debates on the security and long term viability of the company.

So, the event of a air crash or accident of a European low-cost airline is for us the most negative or pessimistic scenario we can imagine for airline traffic in Italy, as consequences of such an occurrence would be widespread and take years to rectify.

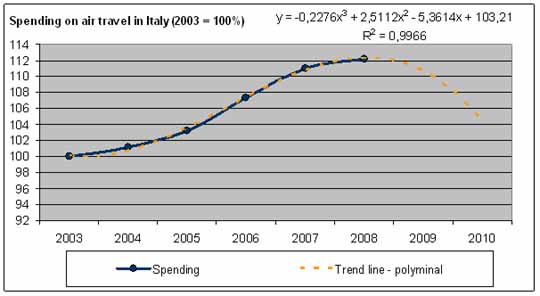

Graph 4.

The increase of sales stops. Bankruptcies of low-cost carriers lead to the increase of the prices as passengers have to use regular services. People still need to travel a lot therefore the level of spending is bigger than before the introduction of low-cost companies but high prices and need of security convince people to start using ground transportation.

Data

All numeric data was taken from the Euromonitor. Forecasting and trend calculation was conducted by team members. For analyzed period two outliers had to be corrected for trend calculation:

1. Impact of introduction of low-cost carriers

2. Market shock caused by terrorist attacks in 2001.

***

Conclusion

As cited in the introduction, we have been curious to have an idea of how the low-cost airlines sector would develop in Italy from 2007 to 2012. We would like to remind that the purpose of scenario planning and scenario building is not to have a clear and exact forecast of future development but to make an idea, draw a range of possible pictures of what trends are going to appear, which of them will probably be more dominant and which will be less dominant. Furthermore, in this study – under given circumstances - being a less large one, we would like to point at rather providing ideas of possible future development of sector than quantitative probabilities of certain events.

Being economists as well, we constantly pose the question: how could low-cost airline companies prepare best for the future? How can they remain competitive and sustain themselves?

To conclude, we can say that what we can really prepare for are here mainly the positive and the neutral scenario trends. The negative scenario of a huge crash or accident or failure of the business model is too difficult and so of less use to prepare for, but we can remind of the threat of other competitors like new budget-airlines, traditional airlines entering the low-end and other low-cost carriers as potential competitors. To prepare for a fierce competition may mean for the strategic vision pointing at uniqueness, searching for competitive advantages especially compared to other carriers and also start stronger building of the brand image. Of course, to a certain extent one can be proactive by giving priority of increasing safety. This might be a direction of growth that would really pay off.

In a positive case, the phenomenon companies have to take into account is growing demand, which means extending destination offers and services, especially to the Middle East, Eastern Europe and Africa. The neutral-case threat stands mainly in increasing petrol prices and consumers’ need for lower prices. On the one hand, together these necessitate cost-cutting measures.

In the end, what should budget-airlines prepare for? For cost-cutting or need for extending destination and services? The good news is that although in forecasting the future you show all alternatives, but in the end you cannot prepare for everything. Although we have considered the neutral scenario as the most probable one, generally the real future scenario turns out to be a combination of the listed scenarios. There will be consumers thriving for new destinations of the recent tourist hubs and there will be ones who want only more safety, another ones will ask for lower costs. As consumers will be probably more wary, a common solution might be to diversify, to adjust more to specific client groups, maybe of specific regions, different risk-averseness and income-level. For instance, clients from South-Italy with a rather average income will probably ask for different kind of service as wealthy clients coming from Northern Italy focusing on safety. This might as well transmit the message for budget-airline companies to go into deeper analysis by doing more specific future-research for their own certain case.

Bibliography

Euromonitor reports :

- Travel and Tourism in Italy (September 2005)

- The World market for Travel and tourism (September 2005)

Websites:

www.easyjet.com

www.ryanair.com

www.alitalia.com

www.volareweb.com

www.reuters.com